InsuranceERM is delighted to announce that the annual Insurance Risk & Capital EMEA conference will take place in London on 4 December 2023.

The conference will cover the most pressing issues facing the re/insurance industry in the region, with a view from Chief Risk Officers, Chief Actuaries and Chief Sustainability Officers.

We not only shared great content with insights from superb speakers, but we also brought the insurance risk community together.

If you are interested in partnering with us for this event, please contact Adam Jordan at [email protected] , to discuss your specific requirements and the opportunities available.

The CRO’s role in supporting the insurance industry’s transformation

Tech innovation and what this really means for the insurance sector

Reputational risk and resiliency

Investments and capital management from the risk perspective

Meeting climate risk regulatory expectations

Total balance sheet approach to net zero commitments

250+

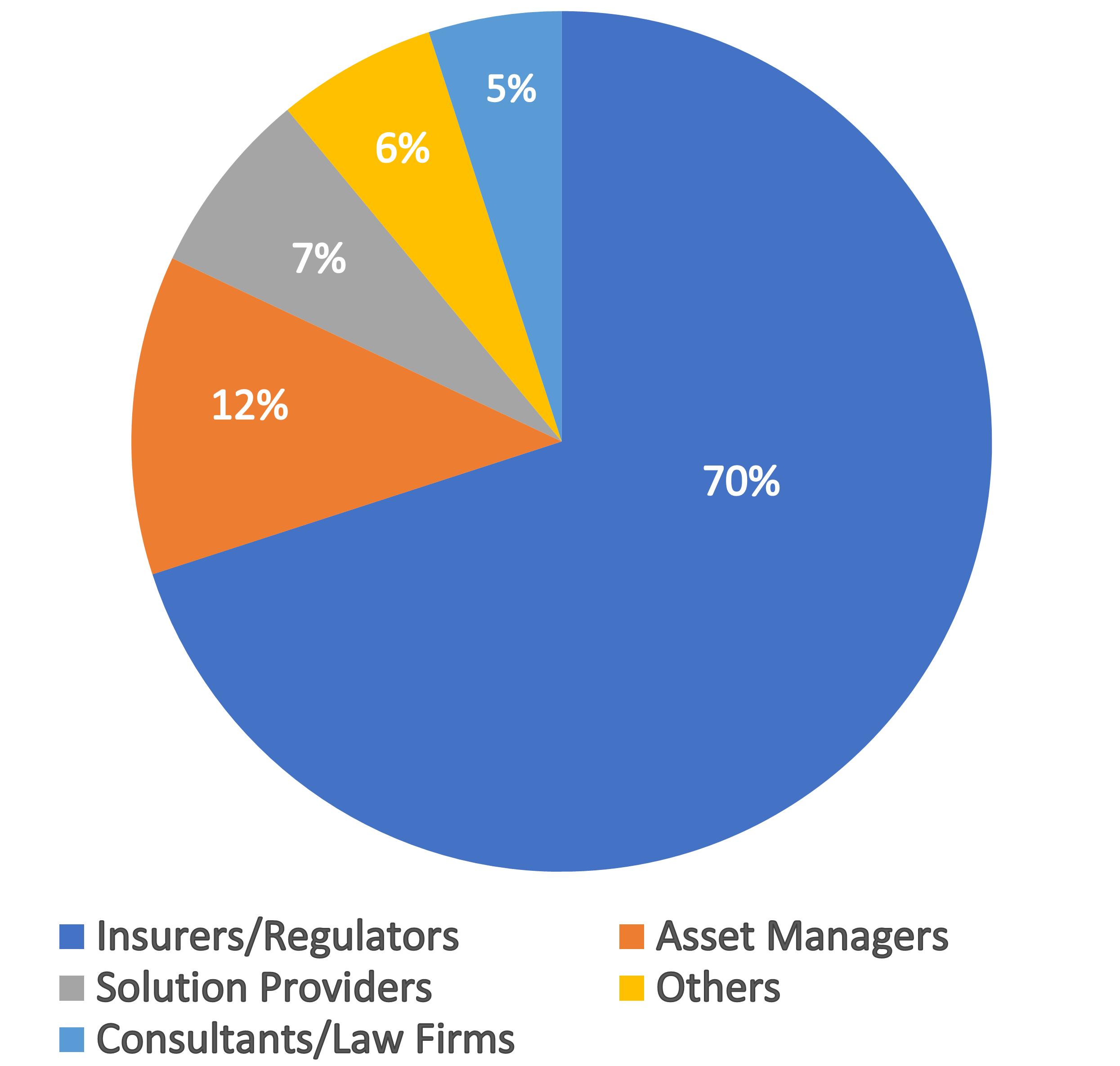

70%

15+

40+

15+

2